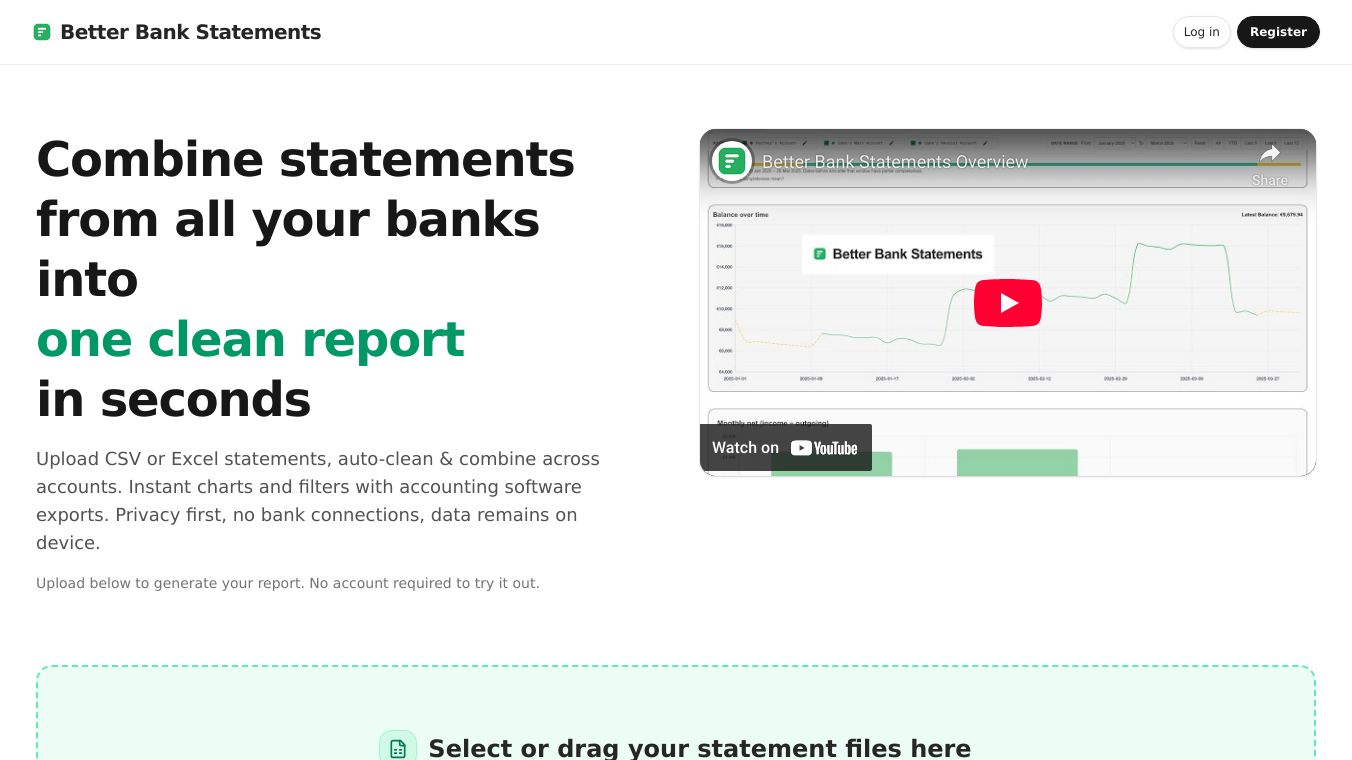

Better Bank Statements: Simplifying Mortgage Applications

Better Bank Statements is a tool designed to help borrowers understand and prepare their bank statements for mortgage applications. It provides insights into what lenders look for in bank statements, helping applicants avoid common pitfalls and streamline the approval process.

Benefits

Better Bank Statements offers several key advantages:

- Educational Insights: It explains what lenders examine in bank statements, such as income stability, spending patterns, and financial health.

- Preparation Guidance: The tool helps borrowers prepare their financial documents to meet lender requirements, reducing the risk of delays or rejections.

- Self-Employed Support: It provides tailored advice for self-employed individuals and freelancers, who often face stricter scrutiny during the mortgage application process.

- Red Flag Identification: Better Bank Statements highlights potential red flags, such as overdrafts, unexplained deposits, and erratic spending, helping borrowers address these issues before applying.

Use Cases

Better Bank Statements is useful for a variety of scenarios:

- First-Time Homebuyers: It helps first-time buyers understand the mortgage application process and prepare their financial documents accordingly.

- Refinancing: Borrowers looking to refinance their current mortgage can use the tool to ensure their bank statements meet lender requirements.

- Self-Employed Borrowers: Freelancers and business owners can benefit from the tailored advice provided for non-traditional income sources.

- Home Equity Loans: Individuals seeking to access their home equity as cash can use Better Bank Statements to prepare their financial documents for the application process.

Additional Information

Better Bank Statements emphasizes the importance of clean financial records and proper documentation. It advises borrowers to start preparing their bank statements well in advance of their mortgage application to address any potential issues and streamline the approval process. The tool also highlights the stricter requirements and higher interest rates associated with bank statement loans, which are often used by self-employed borrowers.

This content is either user submitted or generated using AI technology (including, but not limited to, Google Gemini API, Llama, Grok, and Mistral), based on automated research and analysis of public data sources from search engines like DuckDuckGo, Google Search, and SearXNG, and directly from the tool's own website and with minimal to no human editing/review. THEJO AI is not affiliated with or endorsed by the AI tools or services mentioned. This is provided for informational and reference purposes only, is not an endorsement or official advice, and may contain inaccuracies or biases. Please verify details with original sources.

Comments

Please log in to post a comment.