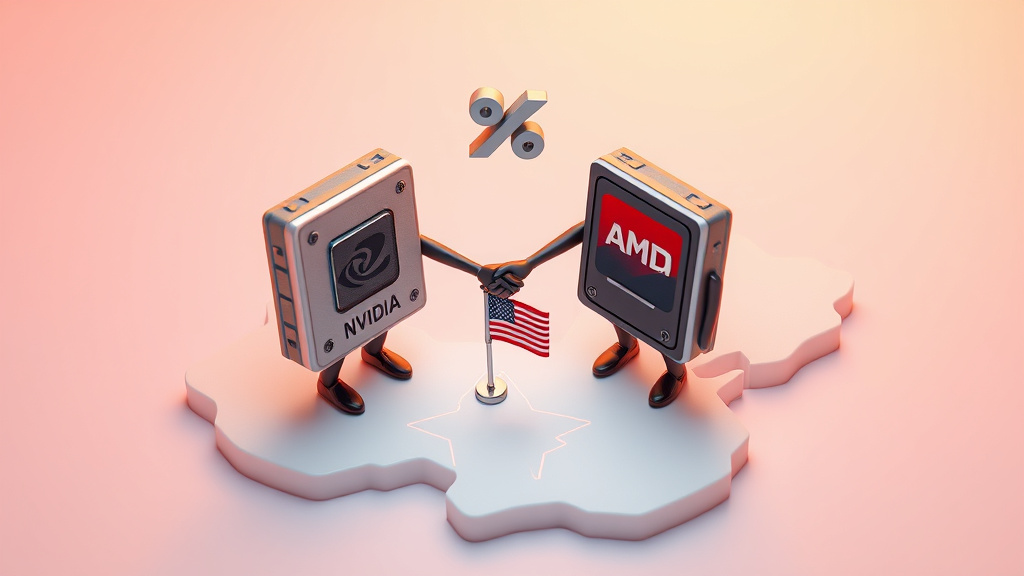

Nvidia and AMD are navigating new regulations in China, agreeing to share 15% of their AI chip revenue from China sales with the U.S. government to secure export licenses for chips like the H20 and MI308. BofA views this deal as a positive step, maintaining buy recommendations for both stocks, while Citi remains neutral on AMD. Despite strong gains this year, both Nvidia and AMD stocks experienced some fluctuation due to these revenue-sharing rules. Nvidia's revenue reached $30 billion, fueled by its Hopper and Blackwell GPUs, while AMD is set to launch its MI350 and MI400 chips to compete. Meanwhile, other AI stocks like Gorilla Technology, Mobileye Global, and Kforce haven't seen the same growth as Nvidia, with Gorilla Technology down nearly 80% since the end of 2022. In other news, BigBear.ai's stock is plummeting after disappointing second-quarter results, reporting a loss of $0.71 per share on $32.5 million in revenue, which is below the expected $40.6 million. The company has lowered its revenue forecast to between $125 million and $140 million due to delayed or reduced government contracts, impacted by changes in the Army's data plans. Conversely, Rezolve AI PLC secured a $50 million investment from new investors to expand its Brain Suite platform and increase sales in the retail and e-commerce sectors. Elsewhere, Brookfield Asset Management is establishing a $5 billion fund for AI infrastructure investments, and DigitalBridge Group is nearing the final close of its DigitalBridge Partners III fund. Lastly, FIS and PS27 Ventures invested over $500,000 in an AI fintech company focused on transforming bank money transfers.

Key Takeaways

- Nvidia and AMD will share 15% of China AI chip revenue with the U.S. government to obtain export licenses.

- BofA maintains a buy rating for both Nvidia and AMD stocks despite the revenue-sharing agreement.

- Nvidia's revenue hit $30 billion, driven by Hopper and Blackwell GPUs.

- AMD is launching MI350 and MI400 chips to compete with Nvidia in the AI chip market.

- BigBear.ai's stock is falling after reporting a $0.71 per share loss on $32.5 million in revenue for Q2.

- BigBear.ai lowered its revenue forecast to $125 million - $140 million due to government contract uncertainties.

- Rezolve AI received a $50 million investment to grow its Brain Suite platform for retail and e-commerce.

- Brookfield Asset Management is creating a $5 billion fund to invest in AI infrastructure.

- FIS and PS27 Ventures invested over $500,000 in an AI fintech company focused on money transfers.

- Some AI stocks, like Gorilla Technology, have not experienced the same growth as Nvidia in 2023.

Nvidia and AMD to share China AI chip revenue with US

Nvidia and AMD will give 15% of their China AI chip sales revenue to the US government. This deal helps them get export licenses for their H20 and MI308 chips. Tom Mackenzie from Bloomberg Television shared these details.

Nvidia, AMD's China AI chip deal is good news says BofA

BofA says Nvidia and AMD's deal to give 15% of China AI chip sales to the US government is a positive step. This deal allows them to get export licenses. BofA analysts still recommend buying Nvidia and Advanced Micro Devices stocks.

Citi says AMD's China AI chip deal is neutral

Citi is staying neutral on Advanced Micro Devices after the deal to share 15% of China AI chip sales with the US government. This deal helps AMD get export licenses. Nvidia will also share 15% of their revenue.

Nvidia, AMD's China AI chip deal is good news says BofA

BofA says Nvidia and AMD's deal to give 15% of China AI chip sales to the US government is a positive step. This deal allows them to get export licenses. BofA analysts still recommend buying Nvidia and Advanced Micro Devices stocks.

BigBear.ai stock drops due to government contract worries

BigBear.ai stock fell because the company expects less revenue due to uncertainty with government contracts. They lowered their revenue forecast to $125 million to $140 million. The company is affected by changes in the Army's data plans. In the second quarter, BigBear.ai lost $0.71 per share, much more than expected.

BigBear.ai stock plunges after disappointing report

BigBear.ai stock is down because its second-quarter sales and earnings were lower than expected. The company also reduced its sales forecast for the year. BigBear.ai didn't get government contracts it expected, raising concerns about its role in defense AI. The company reported a loss of $0.71 per share with $32.5 million in revenue.

BigBear.ai stock crashes after weak earnings report

BigBear.ai's stock is falling because its sales dropped in the second quarter. The company also cut its revenue forecast for the year because of delayed or smaller government contracts. BigBear.ai reported a loss of $0.71 per share on $32.5 million in revenue. The company faces growing losses and has a lot of debt.

Rezolve AI gets $50 million investment from new investors

Rezolve AI PLC received a $50 million investment from two new investors. The company will use the money to grow its Brain Suite platform in global markets. They also plan to increase sales and partnerships. Rezolve AI provides AI solutions for retail and e-commerce to improve customer engagement and sales.

Rezolve AI receives $50 million investment for growth

Rezolve AI PLC got a $50 million investment from new investors. The company will use the money to grow and reach more customers. Rezolve AI offers AI-powered solutions to help businesses connect with customers. This investment should help Rezolve AI innovate and expand its business.

Brookfield plans AI fund, DigitalBridge nears final close

Brookfield Asset Management is creating a new fund to invest in artificial intelligence infrastructure. They want to raise $5 billion for this fund. DigitalBridge Group is close to finishing its DigitalBridge Partners III fund. Meridiam will lead an $11 billion project to improve US highways.

Nvidia and AMD stocks fluctuate amid AI hardware demand

Nvidia and AMD stocks dipped due to US rules on revenue sharing for AI chips sold in China. However, both companies have seen strong gains this year. Nvidia's revenue was $30 billion, driven by its Hopper and Blackwell GPUs. AMD is launching its MI350 and MI400 chips to compete with Nvidia.

Missed Nvidia? These AI stocks could take off

Some AI stocks haven't increased in value as much as Nvidia. Stocks like Gorilla Technology, Mobileye Global, and Kforce are down from the end of 2022. Gorilla Technology's stock is down nearly 80%. Mobileye is working on self-driving car technology. Kforce is a tech staffing firm.

BigBear.ai, Sea, and Starbucks are trending stocks

BigBear.ai's stock is falling because its second-quarter revenue was lower than expected. Sea's stock is rising because the company had record-high sales. Baird analysts say Starbucks' turnaround plan will help the company, upgrading the stock. The US Army's data changes affected BigBear.ai's revenue.

BigBear.ai reports lower than expected Q2 revenue

BigBear.ai Holdings, Inc. announced its second-quarter revenue was $32.5 million. This is less than the $40.6 million that FactSet expected.

FIS and PS27 invest in AI fintech company

FIS and PS27 Ventures invested over $500,000 in an AI-enabled fintech company. This company aims to change how banks handle money transfers.

Sources

- Nvidia, AMD to Pay US 15% of China AI Chip Sales Revenue

- Nvidia, AMD's China AI chip sales deal with US 'an incremental positive,' says BofA

- AMD keeps Neutral rating at Citi after China AI chip sales deal with US

- Nvidia, AMD's China AI chip sales deal with US 'an incremental positive,' says BofA

- BigBear.ai Stock Plummets on Uncertainty About Government Contracts

- Why BigBear.ai Stock Is Plummeting Today @themotleyfool #stocks $BBAI $PLTR

- Why BigBear.ai Stock Is Cratering Today @themotleyfool #stocks $BBAI

- New Investors Back Rezolve AI (RZLV) with $50 Million Investment

- New Investors Back Rezolve AI (RZLV) with $50 Million Investment

- The Pipeline: Brookfield preps AI fund, DigitalBridge eyes final close, Meridiam leads $11bn US PPP

- Nvidia and AMD's Pre-Market Surge: A Rebalance in AI Hardware Demand and Tech Sector Leadership

- Nvidia Got Away? 9 Undiscovered AI Stocks Haven't Taken Off ... Yet

- BigBear.ai, Sea, Starbucks: Trending Tickers

- Earnings Flash (BBAI) BigBear.ai Holdings, Inc. Reports Q2 Revenue $32.5M, vs. FactSet Est of $40.6M

- FIS, PS27 invest $500K+ in AI-enabled fintech company

Comments

Please log in to post a comment.